Why do Financial services need CRM?

Financial services companies need CRM to manage client relationships, streamline communication, and track financial transactions efficiently.

Super-fast Implementation

Rapid implementation allows businesses to start using SuperCRM in a matter of days

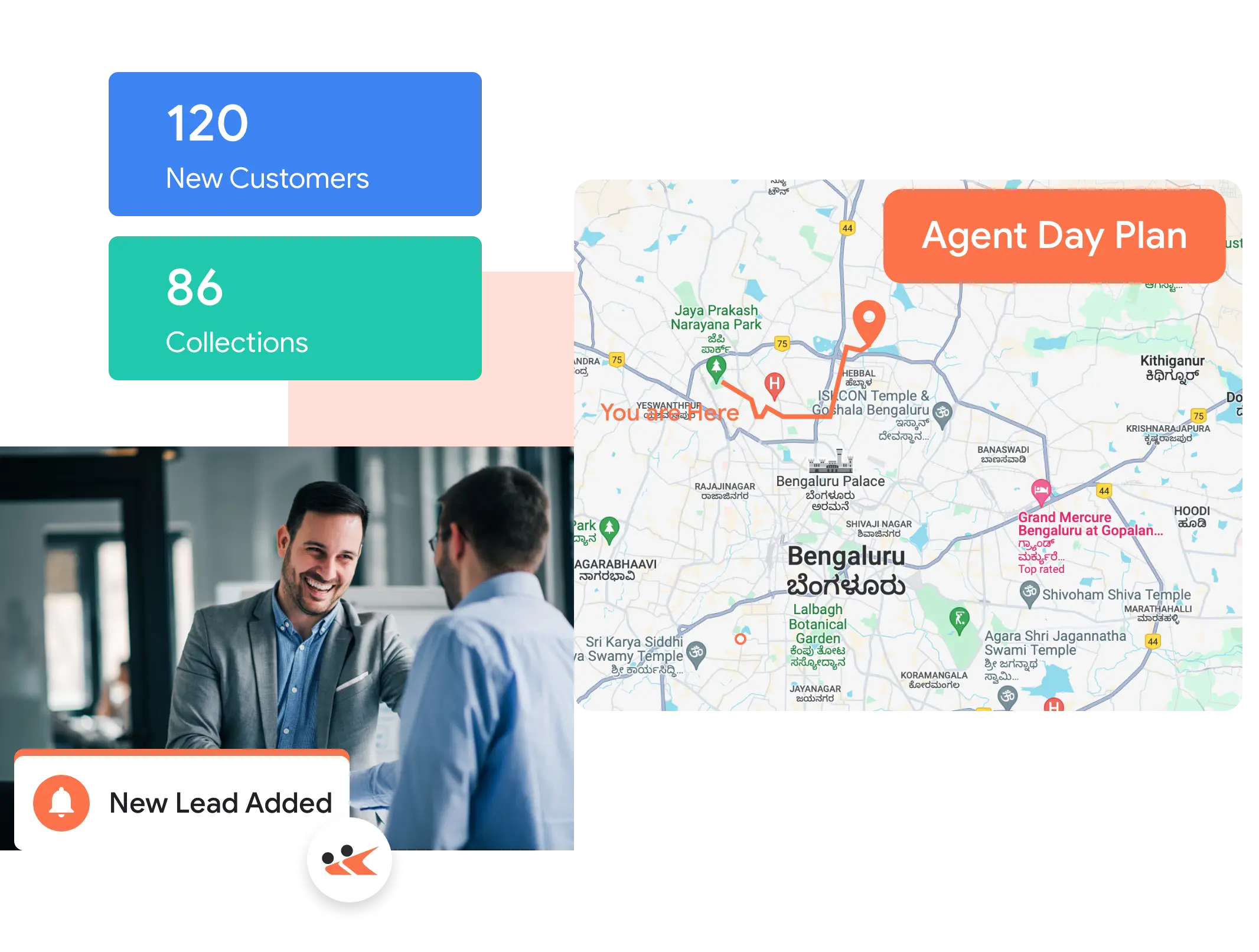

Mobile CRM built for Sales

Agents can efficiently plan their day, identify nearby prospects, and track activities in real-time

Configurable Workflows

Tailor workflows to ensure that customer acquisition, engagement, and sales operations align

Completely Secure

Strict security measures instill confidence in prospects and customers, building trust in the system

Manage Loan Application

The branded digital portal simplifies and accelerates the loan application process, creating a seamless and efficient experience

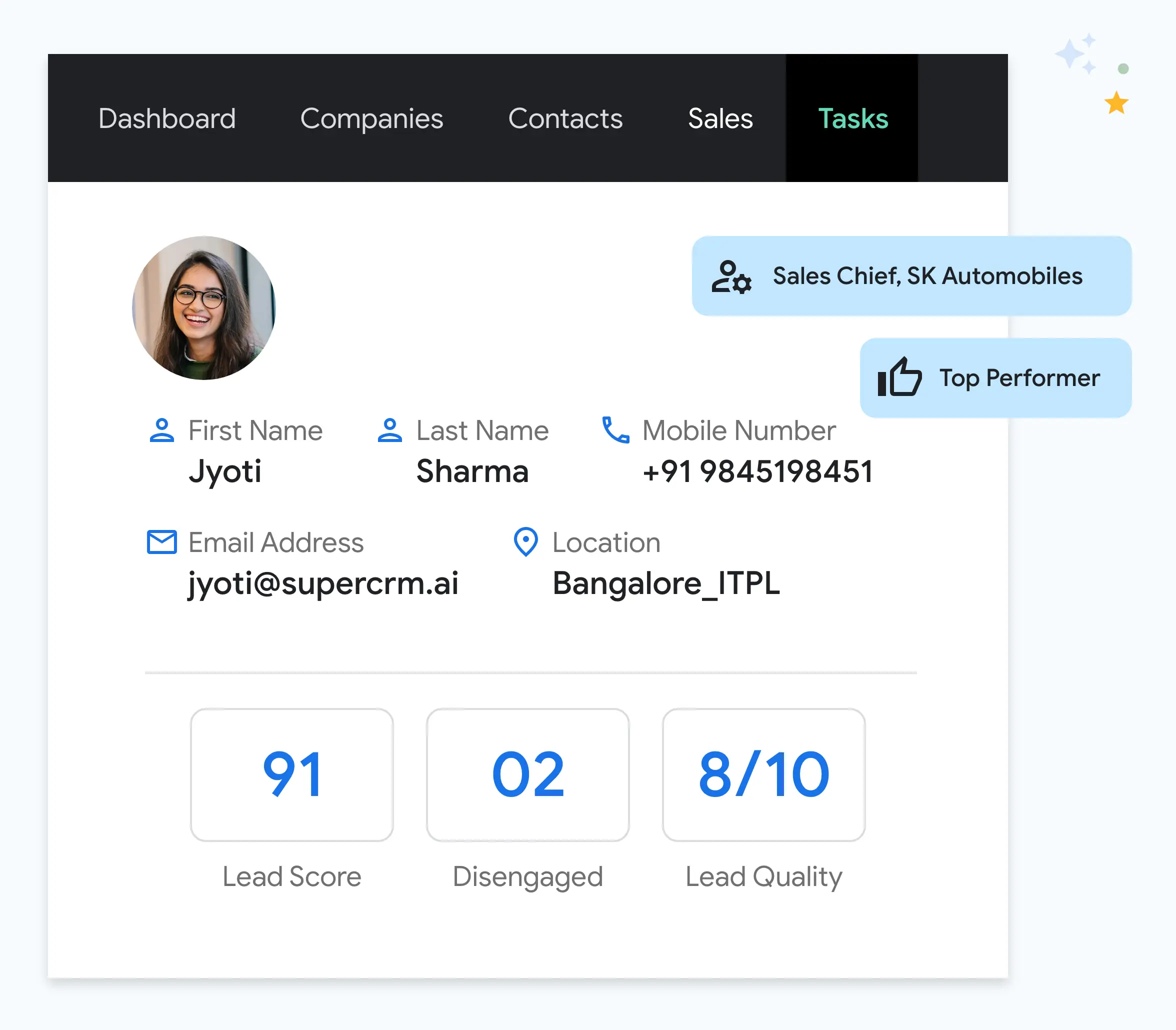

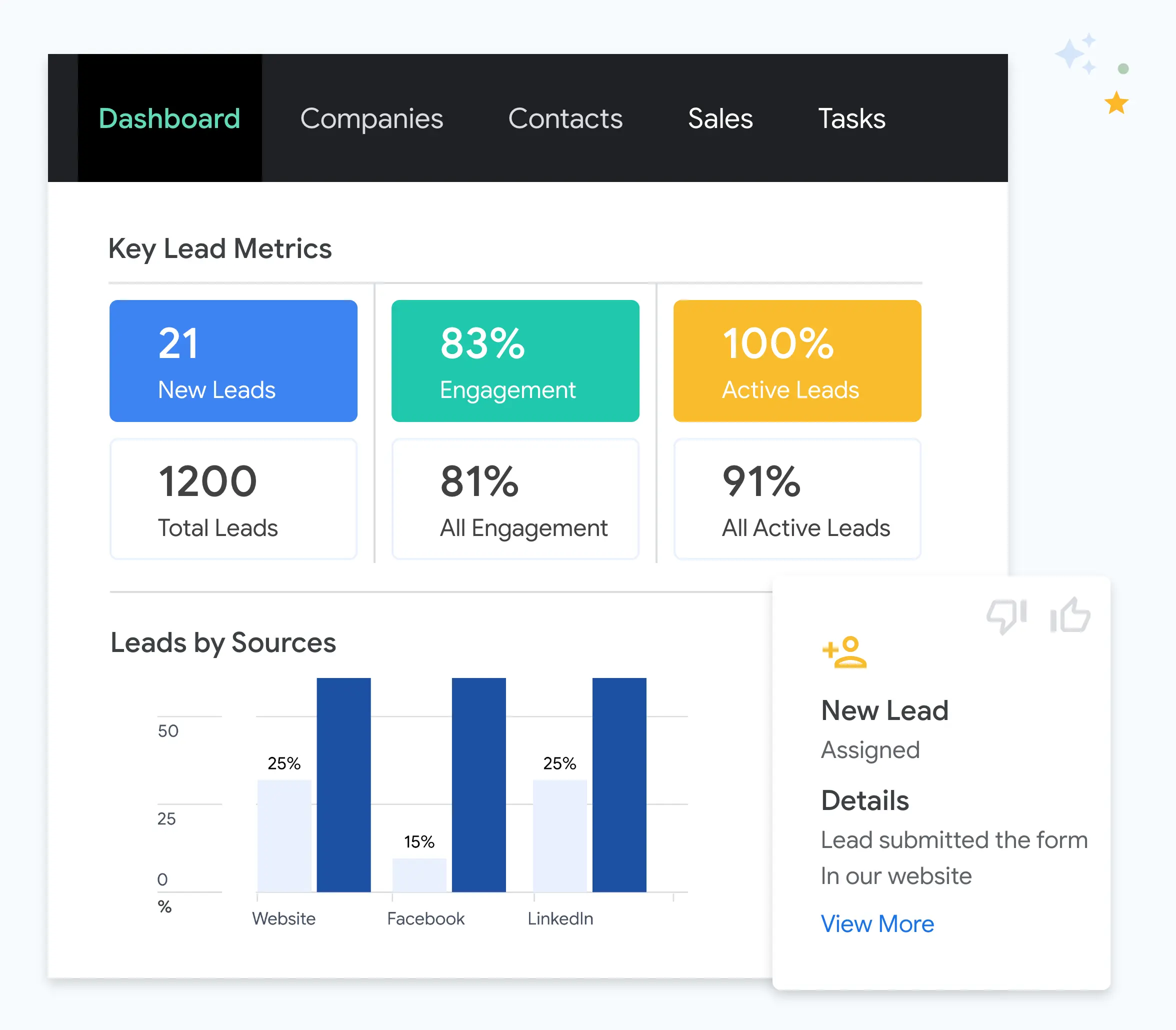

Performance Reports

Reports provide valuable insights, empowering teams and agents to make data-driven decisions

Revolutionizing Banking Sales

- Core Customer Record Integration: Complement your core customer record system for a unified platform.

- End-to-End Customer Lifecycle Management: Acquire, engage, onboard customers, and cross-sell seamlessly.

- Cost Efficiency: Reduce customer acquisition and ownership costs while securely connecting all teams and core systems.

- Rapid Implementation: Super-fast implementation in days compared to months for other enterprise banking software.

- Cost Reduction: Reduce operational costs associated with customer acquisition and management.

- Secure Connectivity: Connect all teams and core systems securely for streamlined operations.

- Diverse Engagement Channels: Drive prospects to conversion through email, text, WhatsApp, call center, and more.

- Enhanced Prospecting: Identify prospects near agents for targeted engagement.

- Holistic Sales Tracking: Track all field activities of agents for comprehensive sales management.

- Efficient Day Planning: Plan agents' daily activities comprehensively for optimized productivity.

- Prospect Identification: Allow agents to identify and engage with prospects in their vicinity.

- Real-time Field Tracking: Track all field activities, ensuring accountability and performance measurement.

CRM for Different Banking Sectors:

- Seamless Customer Acquisition: Streamline the acquisition process from prospect to customer.

- Effective Prospect Communication: Engage with prospects through various channels for increased conversions.

- KYC Verification: Efficiently manage KYC verification processes within the CRM.

- Upsell/Cross-sell Engine: Implement effective upsell and cross-sell strategies for enhanced revenue.

- Connected Systems & Teams: Ensure integration and collaboration across banking systems and teams.

- Borrower Management: Efficiently manage borrower information and interactions.

- Categorization and Prediction: Categorize borrowers and predict recovery outcomes.

- Guided Team Actions: Provide guided actions for the recovery team based on analytics.

- Advanced Analytics: Utilize advanced analytics for proactive debt recovery strategies.

- Holistic Account Management: Manage corporate accounts comprehensively.

- Data Enrichment: Enrich customer data for enhanced insights and relationship management.

- Customer Portfolio Analysis: Analyze and manage the corporate customer portfolio effectively.

- Field Sales Planning: Plan field sales activities for improved corporate banking operations.

You’re gonna love us forever.

Have any thought find here.

Don’t find your answer here? just send us a message for help

Contact us

CRM in banking involves the management of customer relationships, understanding their needs, onboarding new customers, offering timely support, and ensuring customer retention. Specifically designed customer relationship management software for banking helps oversee end-to-end relationships – from inquiry to conversion and beyond.

You can choose a banking CRM that covers all operations or opt for sector-specific CRM, including:

- Corporate banking CRM

- Commercial or Retail banking CRM

- Lending CRM

- Collections CRM

- Investment banking CRM

Utilizing CRM for banks optimally involves providing personalized customer experiences, efficient sales and operations management. Employ behavioral data for personalized, triggered marketing campaigns, leverage predictive analytics to gauge customer sentiments and forecast sales, and automate operational tasks to allocate resources for more intricate relationship-building activities.

SuperCRM captures leads through diverse channels, encompassing digital platforms, phone calls, email, social media, and lending marketplaces. The system automates screening for an efficient attraction of high-quality borrowers.

SuperCRM employs a Process Designer, ensuring a seamless digital experience for teams managing loan application workflows. This enhances the efficiency of pre-screening, sales, and underwriting teams.

SuperCRM places a premium on data security through robust encryption, secure access controls, and regular data backups. Adhering to industry standards guarantees the confidentiality and integrity of borrower information.